Home Loan pre-approval

Posted on: 19.07.2016

What is a home loan pre-approval?

A home loan pre-approval is an indication of how much you are able to borrow, based on the information you provide to the lender. It is a good first step, so you can shop for property with confidence. Most home loan pre-approvals from lenders are valid for between 3-6 months. However, it’s also very important to fully understand your terms and conditions as they do vary from lender to lender.

Touching base with an experienced gold coast mortgage broker like Uprosper could save you a lot of time and stress.

What are some common terms or conditions i should look out for with home loan pre-approval?

The most common issue that we come across:

- Clients that were given the impression from their bank/branch that they can borrow a certain amount. Then when they enter a contract to purchase, upon a complete assessment of the clients financial position by the bank, they are declined. Sometimes once your finance proceeds to full assessment the bank will only consider a portion of your income, say for example you earn regular overtime, however the lender you are proceeding with doesn’t accept overtime.

- ‘Subject to valuation’. This is a valuation that banks/lenders perform on the property your purchasing, and is a standard condition for banks to put on a pre-approval. Keep in mind although it is very rare in today’s market, if the valuation comes in lower than contract price they have the ability to not offer you finance if you are unable to cover the shortfall. For example, If you are pre-approved based on a $400,000 purchase price and enter a contract on a property for $400,000. The banks valuation of the property may come in at $380,000, therefore they will only lend money to you based on $380,000 valuation for that specific property. If you cannot make up the $20,000 shortfall yourself they will not approve the finance.

Summary

Whether you use Uprosper to help you through home loan pre-approval or not, it’s important to ensure the following with whoever you are organizing your pre-approval with:

- Make sure the bank/lender/broker is performing a COMPLETE ASSESSMENT of your financial position. Covering savings pattern, Credit file checks, Liabilities and Assets. Our advice is to ask if your pre-approval has been assessed by the banks credit team. This usually takes between 3-5 business days.

- If you do have a ‘pre-approval’ that is from you providing minimal documents (a few payslips and I.D) the honest truth is, it is more than likely not worth the paper it is written on.

- Try to minimize the terms & conditions with whoever is organizing the pre-approval by providing as much information as possible/requested.

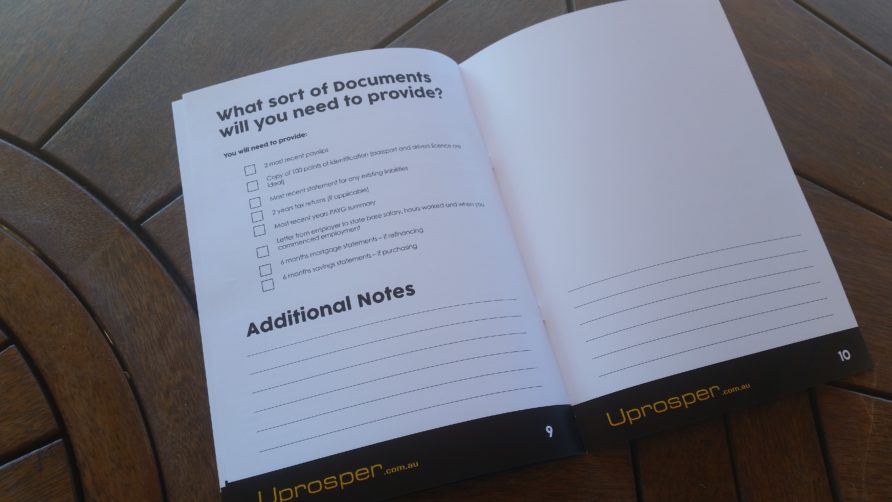

- Most of the documents you’ll need to provide can be found on our Document checklist page.

Don’t forget, we have no fee for our service at any point and over 10 years experience, so feel free to contact us at a time that suits you.

Good luck and all the best,

The Uprosper Team

Back to News